Tracking Stock Tax Treatment

Tracking stock tax treatment. Tax treatment for complex trades triggers a bevy of complex IRS rules geared toward preventing taxpayers from tax avoidance schemes. Tax treatment for outright option trades is fairly straightforward and covered below. Shares under ESOW plan this treatment shall apply regardless of whether the individual is in or outside Singapore as at the date of vesting.

A capital loss can only be used to reduce or eliminate capital gains. If youre an investor infrequent trades with long-term investing horizon youll treat any profits as a capital gain. Additionally you will need to track the cost basis of all securities purchased in order to properly account for gains and losses when filing your taxes.

One benefit index options have over individual stock options is the IRS treats them as Section 1256 Contracts named for the section of the IRS Code that describes how investments like some options must be reported and taxed. In some cases subsidiary tracking stock has been issued as one element of a package of consideration in the acquisition of S by P either on a taxable basis or in a tax-free acquisitive reorganization. Next month well look at the tax treatment of tracking stocks.

The tax would be based on a hypothetical gain determined by an amount equal to the excess of the fair market value of the tracked asset over its adjusted basis according to the Treasury proposal. Deducting losses and expenses from the losing side of a complex trade in the current tax year while deferring income on the offsetting winning position until a subsequent tax year. Implementing tracking stock is not without challenges including initial administrative burden in the form of amendments to the issuers organizational documents which generally requires stockholder approval navigating US.

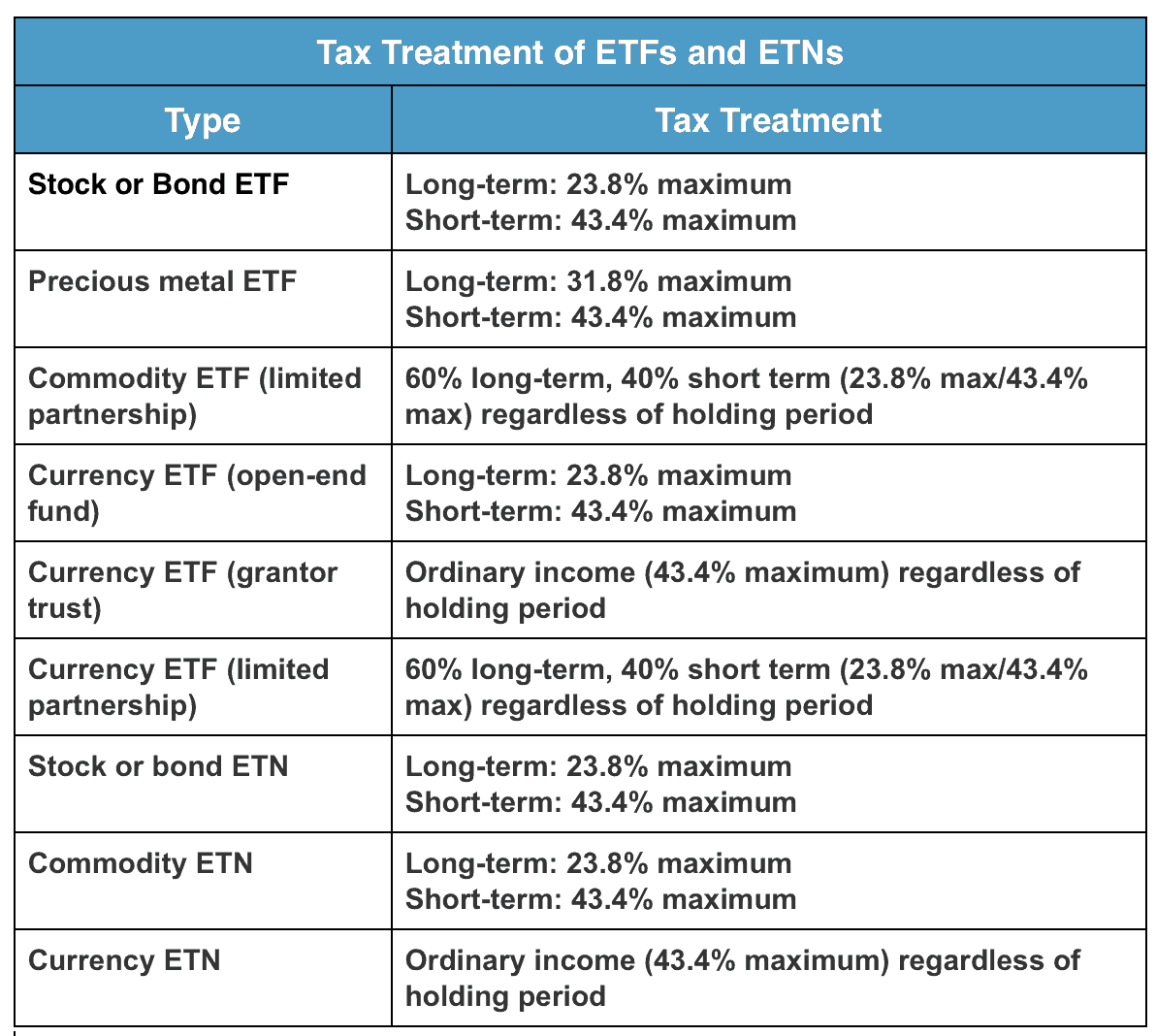

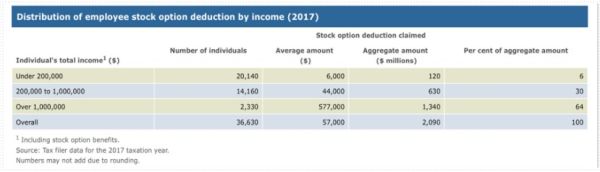

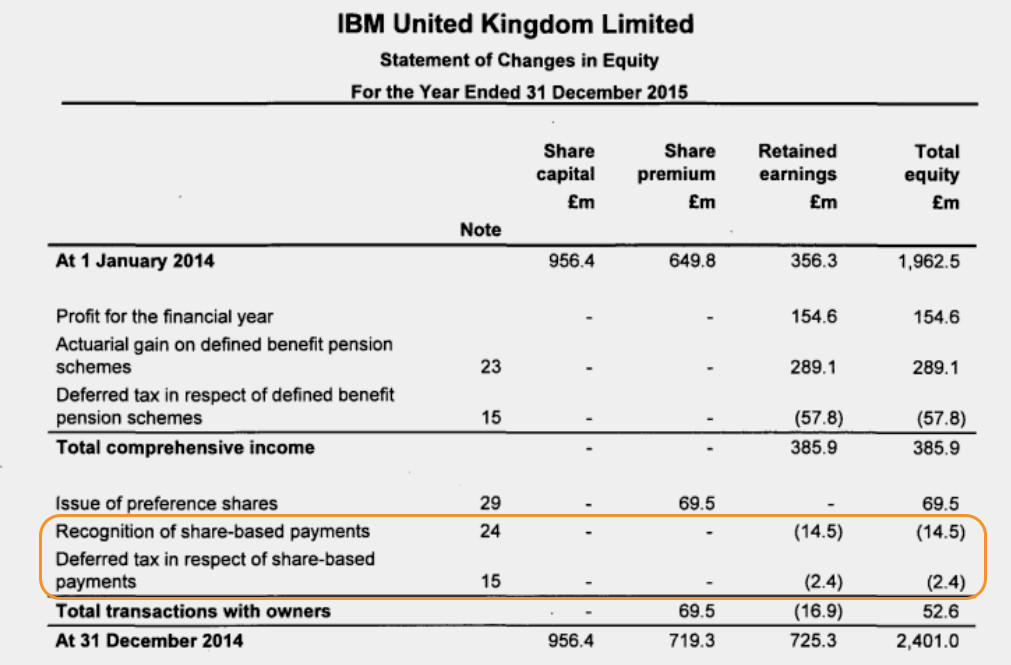

54 The tax treatment of the gains is summarised as follows. Instead EMC shareholders will face taxes in the range of 20 percent to 40 percent for the gains on the cash and the value of the tracking shares. Track stock option exercises qualifiednon-qualified status of stock options and accumulate related taxable amount information for purposes of claiming a corporate tax deduction for financial accounting purposes assuming the company is amortizing the fair value of stock options calculate a deferred tax asset for non-qualifying stock options.

Exercising an ISO is treated as income solely to calculate alternative minimum tax AMT but it is ignored when calculating regular federal income tax. Apparently only ATT Corp. And that brings us to tax treatment.

Tax concerns as well as an ongoing obligation to provide additional financial and narrative disclosure regarding the tracked business. Published by Ian Gamble.

Apparently only ATT Corp.

And Apollo Group Inc. More importantly should the existence of previously issued tracking stock affect. You can write off up to 3000 per year in losses this way. This means 50 of your gains are taxed at your marginal tax rate. The Clinton administrations proposed budget for 2000 includes a provision to tax the issuance of a tracking stock as though it was a sale of assets. Fried Frank Home. If youre an investor infrequent trades with long-term investing horizon youll treat any profits as a capital gain. Track stock option exercises qualifiednon-qualified status of stock options and accumulate related taxable amount information for purposes of claiming a corporate tax deduction for financial accounting purposes assuming the company is amortizing the fair value of stock options calculate a deferred tax asset for non-qualifying stock options. Implementing tracking stock is not without challenges including initial administrative burden in the form of amendments to the issuers organizational documents which generally requires stockholder approval navigating US.

Track stock option exercises qualifiednon-qualified status of stock options and accumulate related taxable amount information for purposes of claiming a corporate tax deduction for financial accounting purposes assuming the company is amortizing the fair value of stock options calculate a deferred tax asset for non-qualifying stock options. Next month well look at the tax treatment of tracking stocks. This means 50 of your gains are taxed at your marginal tax rate. If your stocks have only losses and no gains you can apply the losses to your taxable income. Thus the future remains unclear. Implementing tracking stock is not without challenges including initial administrative burden in the form of amendments to the issuers organizational documents which generally requires stockholder approval navigating US. Tracking stock permits the issuance of an equity security of P the market performance of which is intended to be linked to the performance of S.

/GettyImages-187569189-5c497c1cb19141b4aea3488073f808a8.jpg)

/GettyImages-187569189-5c497c1cb19141b4aea3488073f808a8.jpg)

/GettyImages-914675658-ef28de13799f4a8582e3c46be4e1668a.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/15798444/20151110-michael-dell-future-onstage.0.1499324604.jpg)

Post a Comment for "Tracking Stock Tax Treatment"